Introduction

One of the best methods for paying off high-interest debt is the avalanche method.

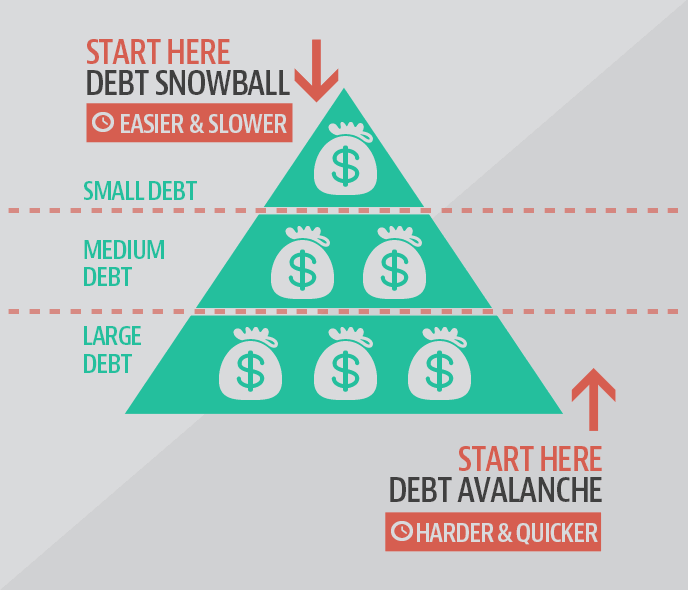

The avalanche method is considered the more “mathematically correct” way to pay off debt, as opposed to the snowball method.

How the avalanche method works

First, make a list.

Create a spreadsheet and list out all of your debts in order from highest interest rate to lowest interest rate.

Make sure you include the due dates for each debt as well.

Then, add it up.

Add up all the minimum amounts you must pay each month and set aside a chunk of money from each paycheck to put towards paying off these debts.

Each month, pay the minimum amount due and then use the remaining money you set aside to put towards the debt with the highest interest rate.

Once the debts with the highest interest rate are paid off, move on to the one with the next highest interest rate, and so on.

As an example, let’s say you have the following debts to repay:

- Credit Card: $5,000, 17.00% APR, $100 monthly payment

- Student Loan: $10,000, 8.0% APR, $70 monthly payment

- Car Loan: $20,000, 7.0% APR, $300 monthly payment

You’ve set aside $700 each month to use toward paying off your debts. That will cover all your minimum payments of $470, plus an extra $230 to put towards your credit card debt because it has the highest interest rate at 17.00% APR.

Following the debt avalanche method, you’d first pay off the credit card, then move on to the student loan, then the car loan because it has the lowest interest rate.

Keep in mind that if a promotional interest rate ends, you might have to reorder your debts from highest to lowest interest rate.

Conclusion

It’s a good idea to monitor your accounts to make sure you’re staying on top of your payments. This list of the best financial management apps can help make it easier to monitor your spending and credit score.

Finance experts like Warren Buffett and Dave Ramsey agree that the avalanche method is the smartest way to pay off debt because it saves you money on interest in the long run, but it may not be the best option for you.

Before deciding on a debt repayment method, crunch the numbers to figure out exactly how much you owe and what the interest rates are.

You should also have a debt repayment goal in mind before choosing a method.

The avalanche method might be the best option for you if:

- You have large, high-interest debts

- You can afford to devote a large chunk of your income to debt repayment

- You have multiple debts with varying interest rates

Whatever method you choose, be sure to stay motivated and keep your end goal in mind!

Pay off your debts first. Freedom from debt is worth more than any amount you can earn.

MARK CUBAN

If you find yourself losing motivation, remember this invaluable piece of advice from billionaire investor Mark Cuban: “Pay off your debts first. Freedom from debt is worth more than any amount you can earn.”

For information on another popular form of debt repayment, check out this article on how to repay debt using the snowball method.