We outperform our competitors in B2B receivables recovery.

As a premier B2B insurance debt and accounts receivables recovery specialist, the value we bring to our clients is the ability to recover the most dollars in the shortest period of time, without compromising amounts owed. Our four-phase approach to collections yields greater results in a shorter period than our competitors.

We are highly regarded and respected for licensure, compliance, bonding and insurance, exceeding state and federal mandates, and providing the most diverse suite of specialty recovery services unrivaled by conventional collection agencies.

The best testament to our abilities, strengths and expertise is from the customers who entrust their assets to Brown & Joseph.

Dedicated Customer Care

Brown & Joseph’s Client Services Department works diligently to maintain our client portfolios and communications, all while ensuring the highest level of customer satisfaction.

Each client is assigned a dedicated representative during our onboarding process. This Brown & Joseph representative is responsible for documenting all requests and is the liaison between the client and all our departments. Their job is to make sure the requests to and from our clients are documented and managed.

The coordination of the entire collection operation is leveraged by the outstanding professional communication of our customer care team. They not only serve as a liaison, but also strive to bring new ideas to the attention of each client — something that works well for one company might also be a perfect fit for another.

With an outstanding 98.2% client retention rate over the last 25+ years, Brown & Joseph’s expert client services team has set the industry standard for excellent customer service.

Technology to move your business forward

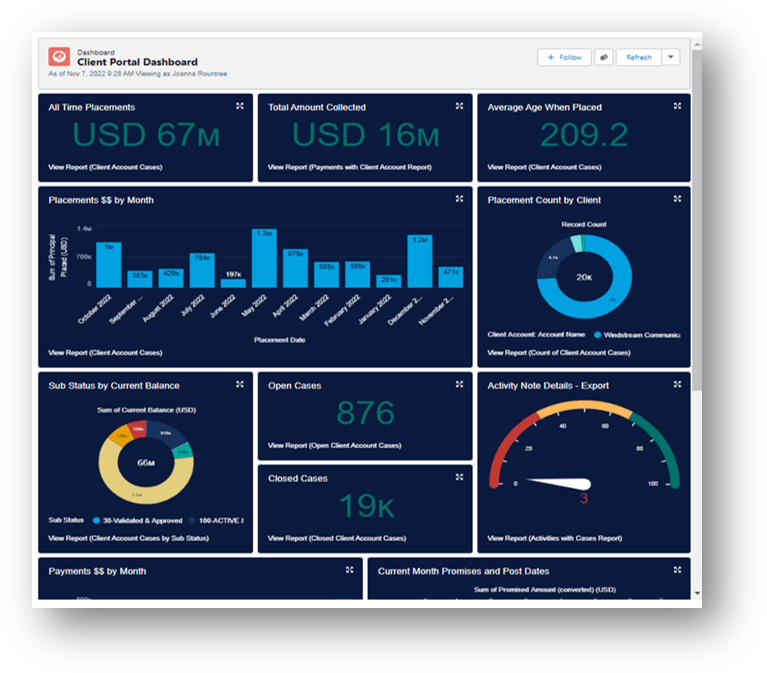

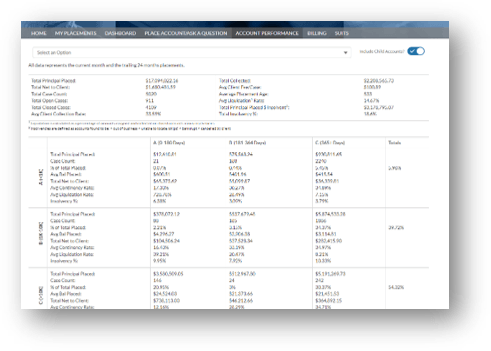

Brown & Joseph uses ARM STRONG™, our proprietary industry leading, end-to-end collections platform that provides 24/7 access to detailed claim information with 100% transparency to all collector activities. Built in partnership with Salesforce.com — the world’s #1 cloud-based customer relationship management (CRM) software provider — ARM STRONG™ automates and accelerates key functions of debt collection, eliminating delays and pain points.

Robust Client Service Features

No-Commitment 2nd Placements

The Brown & Joseph 2nd Placement Program is the perfect way to “test drive” our unique capabilities. We will review and score all accounts returned by your first agency as uncollectible and report our findings to you at no cost, and without disrupting any ongoing or current vendor relationships.