There are 2.5 billion millennials in the world today and by 2025 they’ll make up 75% of the global workforce.

Last month I wrote about a shortage of millennials in the insurance industry and what some companies are doing to combat it.

As Gallup pointed out, “insurance executives who neglect to take steps to engage this age group

In an open letter to the insurance industry at large, insurance executives at top companies stated, “What’s clear is that the critical role our industry plays is not fully understood, particularly among millennials. We need to do more to engage, educate and enlist the best and brightest to join us.”

“Despite our essential role, the insurance industry in the U.S. faces a looming talent crisis. 25% of insurance professionals are expected to retire in three years, and 400,000 positions are projected to be unfilled by 2020,” they added.

According to The Hartford, only 4% of millennials are interested in working in the insurance industry.

A study by Elance found that over half of hiring managers surveyed say it’s not only difficult to find millennials, it’s also difficult to retain them.

So, why is it so difficult?

To answer this question, we first need to understand millennial behavior and what they look for in a career.

Get to know millennials

While there is no precise window, most demographers and researchers agree on 1980 and 1995, although some go all the way up to 2000.

Millennials are often the children of baby boomers, which is why they’re also sometimes referred to as “echo boomers.”

Here are some of the key characteristics of the majority Generation Y, according to research:

They aren’t afraid to job hop.

According to the Pew Research Center, 30% of millennials see themselves working for less than a year at their current company, compared to 21% for Gen X and 17% for baby boomers, who would prefer to stick around longer.

In other words, they aren’t attached to their current roles and are hungry for new experiences.

Based on U.S. job switching activity in 2016, millennials were 50% more likely to relocate and 16% more likely to switch industries for a new job than non-millennials.

The rising rate of millennial turnover is proving to be a huge problem.

Most are in debt.

Millennials are the most highly-educated generation ever, but they’ve accrued massive amounts of student debt.

“Credit cards, student loans, mortgages, car payments — today’s millennials have more debt than ever, and studies show that there can be a long-term health effect on the stress this causes,” says one study from Yellowbrick. “Two-thirds of millennials aged 23 to 35 have at least one source of long-term debt, while one-third have more than one source.”

Additionally, millennials have benefited the least from the economic recovery following the Great Recession, as average incomes for this generation have fallen at twice the general adult population’s total drop and are likely to be on a path toward lower incomes for at least another decade.

They’re tech-savvy.

Most millennials grew up with digital technology and have known it all their lives.

Marc Prensky coined the term “digital native” to describe younger millennials because they “are native speakers of the digital language of computers, video games

According to a study by AdAge, 86% of millennials have a smartphone, spending about 25 hours per week on it.

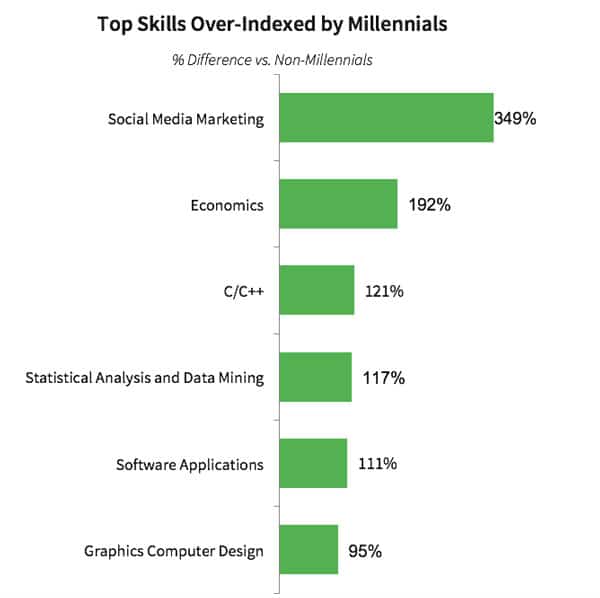

The graph below shows that millennials are much more tech-savvy than their non-millennial counterparts, with their top skills involving social media, coding and software applications.

They’re progressive.

In 2015, a Pew Research study found that 40% of millennials in the U.S. supported government restriction of public speech offensive to minority groups, as opposed to 27% of Gen Xers, 24% of Baby Boomers and only 12% of the Silent Generation.

Millennials have brought many changes to higher education in the U.S. by drawing attention to microaggressions and advocating for the implementation of safe spaces and trigger warnings.

Additionally, a 2013 Pew Research poll found that 84% of millennials favored legalizing the use of marijuana.

Millennials are also more likely to support same-sex marriage and oppose animal testing than previous generations.

What Millennials Want

In order to attract and retain millennials at your company, you need to understand what they want.

Data shows that millennials value different things in a career opportunity than non-millennials.

Purpose

“Purpose is key,” the head of Human Resources at LinkedIn, Pat Wadors, said in a recent article. “Humans want to leave a legacy. And millennials tend to be more intentional about that.”

In fact,

A 2014 publication from the Brookings Institution shows a generational adherence to corporate social responsibility, with surveys from the National Society of High School Scholars (NSHSS) and Universum also showing a preference of millennials to work for companies engaged in the betterment of society.

Millennials’ shift in attitudes has led to data showing that 64% of millennials would take a 60% pay cut to pursue a career path aligned with their passions.

In short,

Career Advancement

Millennials continually cite a strong career path and strong employee development opportunities as qualities they care about in a job.

And, according to a LinkedIn survey of members who switched jobs in 2016, the most frequently cited reason by millennials for leaving a job was a lack of opportunities for career advancement, followed closely by dissatisfaction with compensation/benefits.

Flexibility

According to Antonia

This means they want to focus more on results than on a 40-hour work week, meaning no set schedule and more opportunities to work from home.

Benefits

Millennials want benefits like tuition reimbursement, retirement plans

In fact, a LinkedIn survey from 2016 showed that one of the most frequently cited reason by millennials for leaving a job was dissatisfaction with compensation/benefits.

The Gallup State of the American Workplace Report 2017 says that millennials are likely to leave their current job for a different one if offered benefits like:

- Paid Vacation – 64%

- Flextime – 63%

- Other Insurance Coverage – 60%

- Flexible Location (Off-site Part Time) – 50%

- Flexible Location (Off-site Full Time) – 47%

- Student Loan Reimbursement – 45%

- Tuition Reimbursement – 45%

- Paid Maternity Leave – 44%

- Paid to Work on Independent Project – 42%

- Professional Development Programs – 41%

- Paid Paternity Leave – 37%

- Child Care Reimbursement – 30%

Work-Life Balance

Studies show nearly 1/3 of students’ top priority is to “balance personal and professional life.”

The Brain Drain Study by Emory University shows that 9 out of 10 millennials place importance on work-life balance, with additional surveys showing the generation to place family values over corporate values.

This preference for work-life balance sharply contrasts to the Baby Boomers’ work-centric attitude.

Employers can encourage a healthy work-life balance by offering outside-of-work perks like concert or sporting event tickets.

Ticket Weirdo is one company that partners with corporations to give employees discounts on all ticket purchases.

What Needs to Change

Here’s what needs to happen in the insurance industry to attract younger generations:

Recruiting

According to the 2017 Millennial Hiring Trends Study by MRI Network, 63% of recruiters say talent shortage is their biggest problem, yet 44% of recent grads found it difficult to land a job.

When they decide to look for a new job, referrals are still the number one resource millennials use.

However, this is followed closely by third-party websites and job boards as well as social media, with 1 out of 3 saying they’ve used social media to find a job.

This means that if you want to get your job opportunities in front of millennials, you need to focus on the channels they use.

The same study found that 93% of millennials say they are eager to learn about new job opportunities, so it’s up to recruiters to get their attention.

And, your current employees aren’t only a great resource for traditional referrals – they can help you reach millennial prospects on social media as well.

Marketing Efforts

Undoubtedly, one of the greatest hindrances to attracting millennials to insurance careers is their perception of the industry itself.

Millennials, more than any other generation, are skeptical of large institutions and distrustful of marketing.

Surveys reveal that, as a whole, they know very little about the insurance industry, how it operates or even basic costs of insurance policies.

Lissette Delgado, Agent and Office Manager at JVS Insurance Agency, says, “When I was growing up, I had an impression that insurance professionals were old people who knock on doors with their briefcases in their hand and I was completely wrong! We have a stigma and it’s one of the reasons why I like working directly with young professionals like me. There’s so much more to it than carrying around a briefcase.”

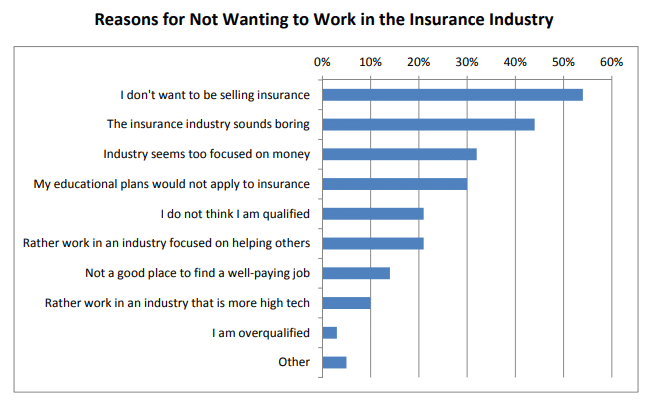

A study by The Institutes found that millennials don’t want to work in the insurance industry because (1) they don’t want to sell insurance and (2) it sounds boring.

“When I was growing up, I had an impression that insurance professionals were old people who knock on doors with their briefcases in their hand and I was completely wrong!”

And when it comes to marketing, many millennials feel traditional insurance companies use too much jargon and have slow, dysfunctional websites.

The insurance industry needs (and deserves) a makeover when it comes to three things: branding, social media

1. Marketing Efforts – Branding

The 2017 Millennial Hiring Trends Study by MRI Network found that 40% of millennials place the most importance on brand and reputation when looking for a company they want to work for:

- Market Reputation (Employer Brand) – 40%

- Goodwill/Community Outreach – 16%

- Employee Ambassadors – 15%

- Online Presence – 12%

- Quick Mobile-apply Process – 11%

- Other – 6%

Many insurance companies need a brand makeover in order to appeal to younger generations.

Millennials engage with brands far more extensively, personally and emotionally—and in entirely different ways—than other generations.

They expect a two-way, mutual relationship with companies and their brands.

According to LinkedIn Global Recruiting Trends 2017, 80% of recruiters say employer branding has a significant impact on hiring talent.

And, 40% of millennials say market reputation has the biggest influence on their impression of an employer.

Brands like Casper, Raden and Glossier have done it right when it comes to marketing to millennials.

These brands exemplify the three things millennials want in a brand: authenticity, transparency and

They don’t want to be marketed to — they want to be part of the conversation.

Millennials are one of the most loyal generations, so insurance companies have a lot to gain if they can offer millennials the brand experience they want.

In his talk at a 2016 Property Innovation Summit, entrepreneur (and millennial) Michael Parrish DuDell said: “If you figure out how to win us

But, DuDell offered a warning: “We know how to spot a faker. We know when you are being inauthentic. We know when you are being dishonest. And we turn off.”

2. Marketing Efforts – Social Media

About 50% of millennials currently follow and interact with brands on social media and 60% say they’re likely to purchase from a brand they follow.

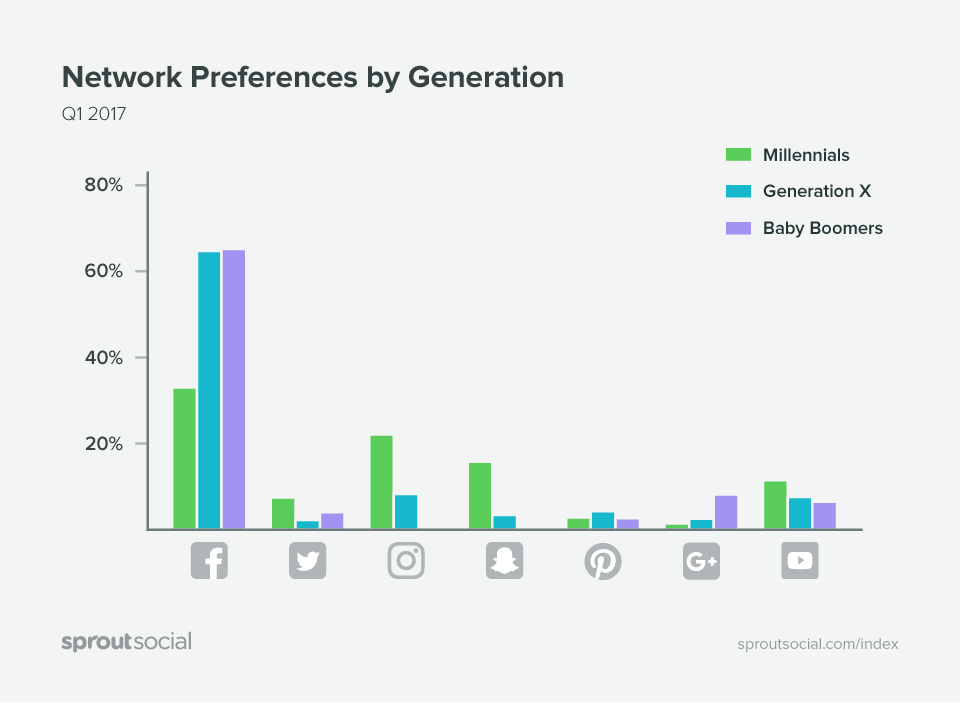

Getting active on popular social media platforms like Facebook and Instagram is the easiest, most effective way to reach millennials.

Property Casualty 360 found that engaging millennials requires organizations to fully embrace technology, from running active social media accounts to the creation and dissemination of easily-shareable content.

But, don’t try too hard. Millennials know when they’re being marketed to, and as DuDell said, they can sense ingenuity.

The most notable example of a millennial marketing fail is Hillary Clinton’s cringe-worthy tweet about student loan debt (a serious crisis for millennials), earning her the sarcastic nickname “Chillary Clinton.”

This generation wants to be taken seriously. Don’t patronize them.

On the other hand, one of the best examples of a company using social media to attract more millennials is an enterprise application software company called SAP.

SAP knows exactly what millennials want, and the company gives it to them.

This excerpt from the SAP website illustrates how in tune with millennials they are: “SAP is one of the biggest business software companies in the world, but we’ve never lost our entrepreneurial spirit. We keep it by hiring millennials and young professionals who think differently and push businesses to do things simpler, faster, smarter, and more sustainably. Join SAP as an intern, a new grad, or even after a couple years’ experience. We’ll put you in the game – and happily invest in your career growth and development. “

SAP offers on-campus programs, internships and vocational training to specifically target and recruit millennials.

The company also created a series of videos about life at SAP to give millennials an idea of the company culture and values, something younger generations greatly care about.

“The opportunity here is stunning. If we equip millennials with the best technology and empower them with permission to be bold, I think we’ll watch the next great generation do incredible things,” says Bill McDermott, CEO of SAP.

And, it’s worth noting that SAP’s approach is working: 46% of SAP employees are millennials.

Finally, one of the easier ways to utilize social media and raise awareness is to take part in Insurance Careers Month (ICM) each year during February.

Click here for a social media resource guide.

3. Marketing Efforts – Advertising

Advertisers have their work cut out for them when it comes to targeting millennials.

According to a study by Bodden Partners, 84% of Millennials don’t like traditional advertising and don’t trust it. Having grown up surrounded by ads, today’s young consumers have grown adept at skipping, blocking and ignoring ads.

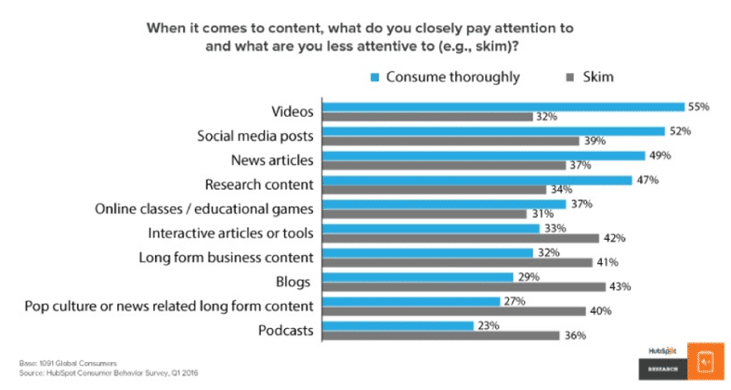

Additionally, less of the younger generations are watching TV, so it may be time to stop spending money on television and print advertising and focus solely on digital marketing.

Millennials are notorious for their short attention span — 8 seconds, to be exact, which is, in fact, shorter than the attention span of a goldfish.

But, it’s even shorter when it comes to advertisements.

A new study by comScore found that millennial attention spans require ads that are just 5 to 6 seconds in length.

If you want to succeed in advertising to millennials, you need to be bold, catchy, in-tune with millennial culture and honest.

Don’t forget that millennials desire purpose above all, so if you want to attract young talent, you need to sell a job beyond just a salary and benefits.

Instead, sell a vision.

Mentorship

There are many opportunities for mentorship in the insurance industry, and this needs to be highlighted more often.

Millennials want to be mentored and they want that professional connection with someone they respect and look up to.

A Gallup study found that employees who are supervised by a highly engaged manager are 59% more likely to be engaged.

Insurance veterans need to do their part in mentoring the younger generations and “taking them under their wing.”

Providing guidance and mentorship can also increase millennial loyalty — something proving to be just as difficult as reaching them in the first place.

Internships

Offering internships

According to a report by Accenture, 78% of 2017 grads completed an internship or apprenticeship.

Millennials love gaining experience, and most are willing to gain experience without being paid.

In fact, millennials are increasingly valuing internships above academics, with 7 out of 10 saying that internship experience matters more than grades.

According to research by Forbes, 65% of employers expect new recruits to have completed two or more internships, while 35% felt that three internships were the minimum students should have completed before graduating from college.

If you expect new hires to have internship experience, then offer it!

Training

A report from Accenture states that 97% of 2017 grads said they will need on-the-job training to further their careers.

And, 83% of 2017 grads believe their education prepared them for their career, but 84% still expect formal training.

Companies need to be willing to train new employees if they want to attract younger generations.

Take a look at your current training program and ask yourself these questions:

- Is it engaging?

- Is it collaborative?

- Does it utilize technology like video or online courses?

- Are training sessions short and concise?

- Is the training continuous?

- Does it produce good results?

Consider giving your training program a makeover if the majority of your answers were “no.”

Incentives/Benefits

“Work-at-home and flexible work options are becoming increasingly popular retention tools. As the labor market tightens and recruitment becomes more challenging, flexible work is a great opportunity to expand the talent pool,” says Catherine Prete, Senior Vice President of Operations at The Jacobson Group.

A recent Capital Group survey found that one in three millennials say a 529 or college savings plan is a benefit they want employers to offer, and even more want tuition reimbursement.

Other incentives include pet insurance, paid maternity and paternity leave, gym memberships, child care

Wadors suggests having benefits and perks that give choice to the recipient, instead of a one-size-fits-all approach.

For example, a new wellness program at LinkedIn offers employees $500 per quarter to spend on whatever health-related program they want: massages, a gym membership, yoga classes, etc.

This gives people the power to choose what works for them, instead of offering everyone the same thing that they may or may not use.

Career Development

Like every other generation, millennials want to develop their professional skillset and advance in their careers.

In a 2016 Gallup Report on “What Millennials Want from Work and Life,” 87% of millennials said professional development was important to their job.

According to Fast Company, one of the biggest drivers of high turnover is the belief that there are better professional development opportunities further afield.

In a 2017 study by MRI Network, 53% of millennials say that career pathing (mapping of incremental new roles in a company) has the most impact on their decision to stay with a company.

However, most of them don’t view career paths as linear. Instead, they might be interested in moving left, right and back down before moving up.

A great way to satisfy their hunger for skills and advancement is to let them explore the company through networking, social events and job shadowing their colleagues.

This allows them to get to know the company on a deeper level and decide which direction they want to move in.

The Career Trifecta

Insurance is a dynamic, ever-changing industry that has a lot to offer younger generations.

A study by The Institutes found that millennials want a career where they can (1) help others and improve society and (2) solve problems, which is exactly what the insurance industry is all about.

As the leaders of Hamilton Insurance Group, Lloyd’s and Marsh & McLennan Companies put it, “Without insurance, there is no investment, there is no innovation, and there is no growth.”