Introduction

There are four main benefactors to overpayments in the healthcare industry:

- The Patient

- The Provider

- The Billing Company

- The Payer

As the Office of the Inspector General (OIG) states, “Billing companies should institute procedures to provide for timely and accurate reporting to both the provider and the healthcare program of overpayments.”

When the Affordable Care Act (ACA) passed in 2010, it created a requirement known as the “60-Day Rule” under which individuals and institutional healthcare providers must report and return overpayments “by the later of” 60 days.

Then, in 2016 the Centers for Medicare & Medicaid Services (CMS) created the “Final Rule” in an attempt to clarify the 60-Day Rule.

The Final Rule states that an overpayment has not been “identified” until a provider or supplier has – or should have – determined evidence of an overpayment through “reasonable diligence” and quantified the amount of the overpayment.

The “should have” in this case is included in the rule’s wording to prevent parties from burying their heads in the sand and failing to reasonably investigate potential overpayments.

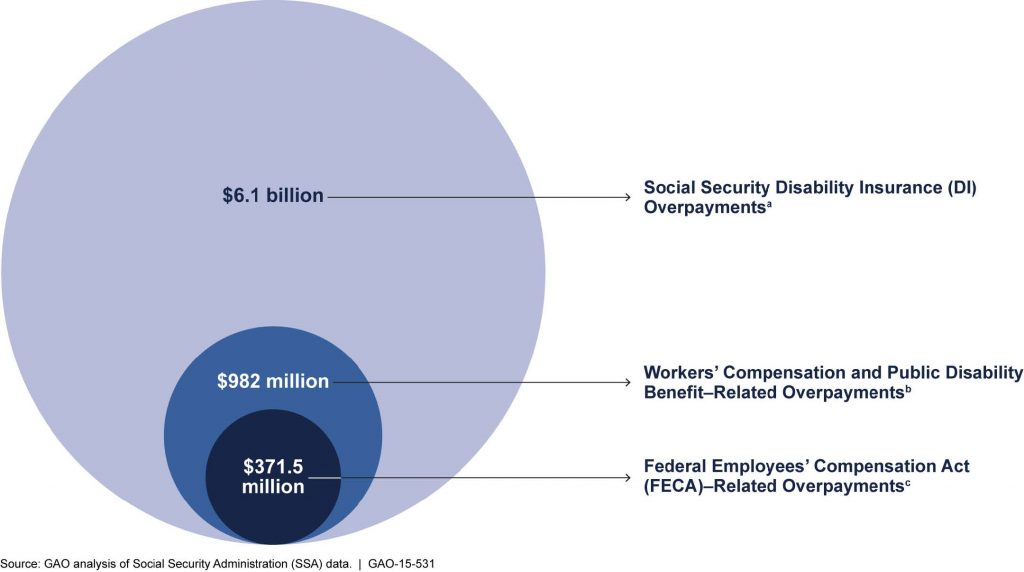

How to handle disability overpayments successfully

Overpayments occur for many reasons. They can happen when a plan member:

- is awarded retroactive benefits through a government-sponsored disability program or retirement program

- returns to work earlier than expected

- receives other income benefits for the same period in which long-term disability benefits are being received and the carrier is not immediately notified

When claimants have been in receipt of excess disability benefits, it is often a challenge to recover those overpayments.

Take the following steps to maximize overpayment recovery results.

Identify and overcome any concerns

When trying to recover an overpayment on a disability claim, Brown & Joseph case managers know that it’s critical to 1.) identify the root concerns that a claimant has with the overpayments early; and 2.) address and overcome any concerns quickly.

This is a significant first step in the overall recovery process of an overpayment.

Common questions or objections a claimant may have

- I did not receive that much.

- Social Security pays 30 days behind, but in reality, based on our clients’ numbers, SSDI takes up to 18 months. This can contribute to a retroactive payment being short 1-2 months of an overpayment calculation

.

- Social Security pays 30 days behind, but in reality, based on our clients’ numbers, SSDI takes up to 18 months. This can contribute to a retroactive payment being short 1-2 months of an overpayment calculation

Check if the claimant received the retroactive payment and/or other income benefits. In some cases, the benefits may have been delayed, withheld or not received.- The monthly amount I am receiving is not as much as is being used to recalculate.

- Retroactive payment amounts are calculated from the gross dollar amount awarded

Review all details on the initial claim

Look over the initial claim and verify all the details.

- Make sure the phone number is entered correctly

- Verify payable benefits

- Confirm start date of withholdings

- Review gross overpayment vs. net overpayment after credits due

When promptly identifying these points, you can minimize confusion on initial contact and increase the potential of overpayment recovery.

Verify the overpayment calculations and provide a detailed explanation

You will need to provide a detailed explanation of the overpayment to the plan member by phone and in writing, including how it was calculated and why it resulted in an overpayment:

- SSDI overpayments are retroactive to a date 5 full calendar months or in some cases, up to 18 months after the application for benefits was submitted.

- A Social Security overpayment is calculated using the entitlement amount (lesser amount awarded before Cost of Living Adjustment increases).

Request full repayment

If full repayment is not possible, consider and negotiate reasonable arrangements to recoup the overpayment.

This includes, but is not limited to:

- Lump-sum partial reimbursement + benefit withholdings

- Lump-sum partial reimbursement + monthly payments

- Short Term Payment Plan not exceeding 18-24 monthly depending on balance size

Follow up

Follow up every 7-10 days, by phone and in writing, if the plan member does not intend to repay the overpayment.

Conclusion

If after 60-90 days of follow-ups you have not received repayment (unless substantiated), analyze and consider all possible next steps.

This could include further negotiation of a repayment schedule with the claimant, referral to another case manager.

Brown & Joseph is continually looking to gain a deeper understanding of the services that insurance carriers provide to their customers.

In fact, last year Dave Robbins and Dennis Falletti of Brown & Joseph had a unique opportunity to see those services firsthand during a visit to Quality Living, Inc. (QLI), a nonprofit dedicated to delivering life-changing rehabilitation and care for individuals with neurological disabilities, including brain and spinal cord injuries and stroke rehabilitation.

Brown & Joseph’s recovery programs are designed to meet our clients’ needs at all steps of the overpayment recovery process while ensuring claimants are treated fairly and respectfully.

Early Intervention Program

With this program, disability overpayment cases are placed for recovery within 10 days from the date the initial overpayment is calculated and the notification letter is sent.

Placing these cases during this time frame will maximize the recovery of the overpayment simply because we address the issue with the claimant before they have a chance to spend the money.

This program is client-oriented and designed to facilitate the overpayment refund process, troubleshooting claim issues and managing withholding payment plans.

Overpayment Collection Program

This program is for cases that have been in overpayment status from 11 to 90 days past due and received limited recovery treatment through by our client’s internal staff.

Aged Overpayment

This program addresses older overpayments that have received extensive internal recovery treatment through our client’s internal staff with an average age of over 180 days.