Introduction

Although the number of Americans with health insurance is at a record high, hospitals are struggling with growing amounts of bad medical debt.

Sage Growth Partners, a healthcare business consultant agency, conducted a survey of 100 hospital executives and found that 59% blamed insurance reform for high levels of bad medical debt, including rising patient copays and deductions.

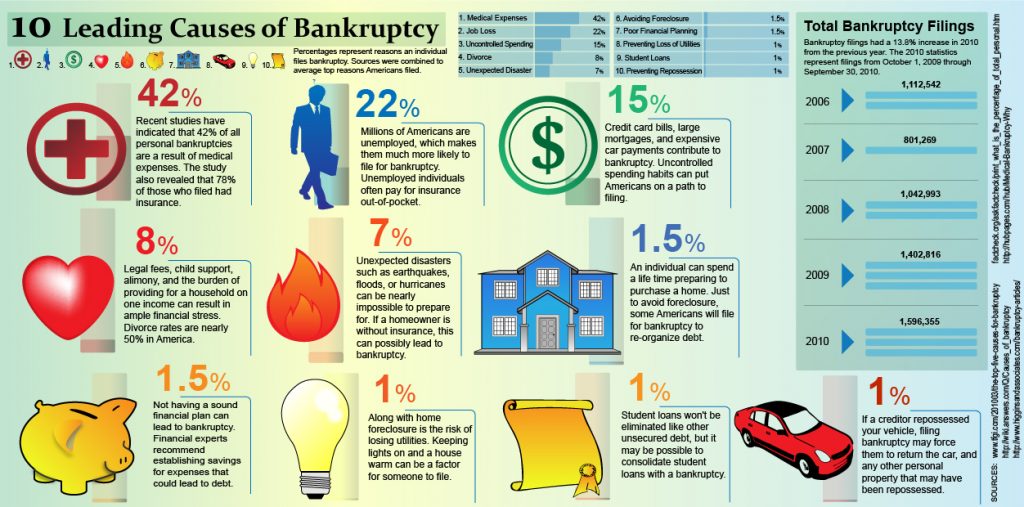

In 2014, over 75 million people complained they were having problems paying off medical debt, which is the number one cause of bankruptcy in the U.S.

According to the Kaiser Family Foundation, the average cost of an emergency room visit can be as high as $2,200. If you need to take an ambulance, that’ll cost an extra $1,000 on average.

Furthermore, a 2017 survey of 1,000 individuals by Bankrate.com found that about half of adults with workplace insurance coverage said they were shocked at the high cost of their medical expenses.

Many patients who fail to pay back their medical bills are actually middle-class, insured citizens who simply refuse to pay for the skyrocketing out-of-pocket expenses of healthcare.

Rising Deductibles

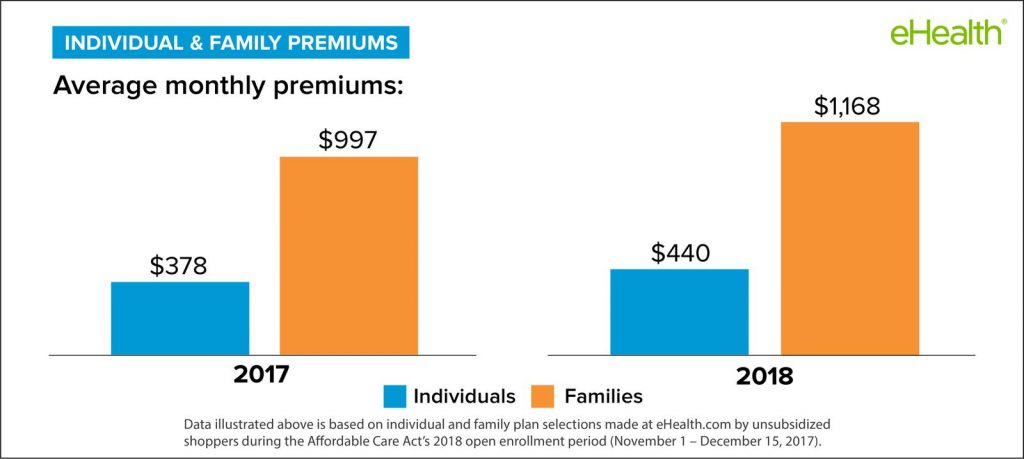

The exact causes of rising insurance premiums are complicated, but there are a few factors that contribute the most.

First, according to a 2015 report, insurance companies underestimated how many claims they would have to cover that year and lost almost $3 billion, which they’re now struggling to make up for.

On top of that, the patients who need the most care generate 49% of all health care expenditures, which creates unequal distribution among insureds and throws off estimates.

Due to these inaccurate estimates, insurance companies are adjusting premiums to account for actual costs, which are pretty high.

Another reason for rising insurance costs is the Affordable Care Act, also referred to as Obamacare.

A 2015 study by Blue Cross Blue Shield, the medical claim costs of individuals enrolled in Obamacare are about 22% higher than those in employer-based groups.

A 2016 article from The Motley Fool explains it best:

“Prior to Obamacare’s implementation, insurers had the ability to handpick who they’d insure. This meant people with pre-existing conditions, who were potentially costly for insurers to treat, could be legally denied coverage. However, under Obamacare insurers aren’t allowed to deny coverage based on pre-existing conditions. When Obamacare became the health law of the land, Americans who’d been ostracized from the healthcare network for having pre-existing conditions flooded back in, leading to adverse selection for insurers. Compounded with too few young adults enrolling, this has led to high medical costs, and even losses, for many insurers operating on Obamacare’s marketplace exchanges.”

According to an estimate by Citi Retail Services, a division of Citigroup, by 2019 providers could see a 50% increase in revenue collected directly from patients, with 30% of that amount being written off.

Broken Debt Recovery Process

Out of the 100 hospital executives surveyed by Sage Growth Partners who reported that their systems had $10 million or more in bad medical debt, only half think they’ll be able to recover at least 10%.

Advocate Health Care, the largest hospital network in Illinois, saw its uncollectible accounts skyrocket more than 22% in 2016, amounting to over $269 million in lost revenue.

“Bad debt is an industry-wide issue that has only grown increasingly more challenging in the last five years,” Dan D’Orazio, CEO of Sage Growth Partners, said in a press release dated June 19, 2018.

“While external factors like insurance reform have compounded the problem, it’s important for leaders to talk about this issue strategically with their teams, and to remember that there are steps they can take to mitigate bad debt,” he added.

“While external factors like insurance reform have compounded the problem, it’s important for leaders to talk about this issue strategically with their teams, and to remember that there are steps they can take to mitigate bad debt.”

Edward Kennedy, CEO of Dorado Systems, added that healthcare leaders can “understandably feel like they don’t have control over bad debt and blame it on external factors, but unless they’re already rechecking insurance every day, it’s likely that there’s more they could be doing.”

More key findings from the survey include:

- 21% of respondents are using neither an in-house process nor a third-party vendor for bad debt recovery.

- More than 36% are using a third-party vendor as a bad debt recovery solution and 25% have created an in-house process for bad debt recovery; 18% are using both approaches.

- While 82% report they re-check patient insurance eligibility, almost 18% do not.

- Of those who do not re-check patient insurance eligibility, almost 28% also have no in-house process or third-party partner for bad debt recovery.

The online survey was administered to hospital C-suite executives and finance leaders in May 2018 and collected 100 responses. Respondent titles included CFOs (36%), CEOs (18%), directors (26%), VPs (10%), COOs (4%), managers (3%), supervisors and other (3%).

Small, medium and large organizations were represented evenly: less than 50 beds (22%), 50-100 beds (20%) 101-200 beds (20%), 201-500 beds (20%), more than 500 beds (18%).

Conclusion

What’s clear is that there’s a considerable amount of bad medical debt being written off.

One in five organizations still has no process in place to recover bad medical debt, which could be costing them millions each year.

Kennedy believes these organizations need to take action: “Whether it’s through internal processes or external partners, provider organizations should take proactive actions to ensure they get paid as much as possible for the care that was provided.”