As driverless cars like Waymo and Tesla and the concept of ride sharing gain more popularity, so do growing concerns about safety and car insurance.

Most consumers say they’re not ready to get into an autonomous car due to safety concerns like technology failure.

In fact, according to a new study from AAA, 63% of U.S. drivers report feeling afraid to ride in a fully self-driving vehicle.

This percentage is a significant decrease from the 78% of drivers who reported feeling afraid in early 2017.

While these vehicles have been tested relentlessly, and statistics show that 94% of accidents are due to human error instead of a technological error, it’s still an uneasy feeling to leave your life in the hands of pure technology — especially after a recent fatality.

Earlier this year, a pedestrian was hit and killed by a driverless Uber car in Arizona, causing even more safety concerns.

First, let’s take a more in-depth look at automated driving.

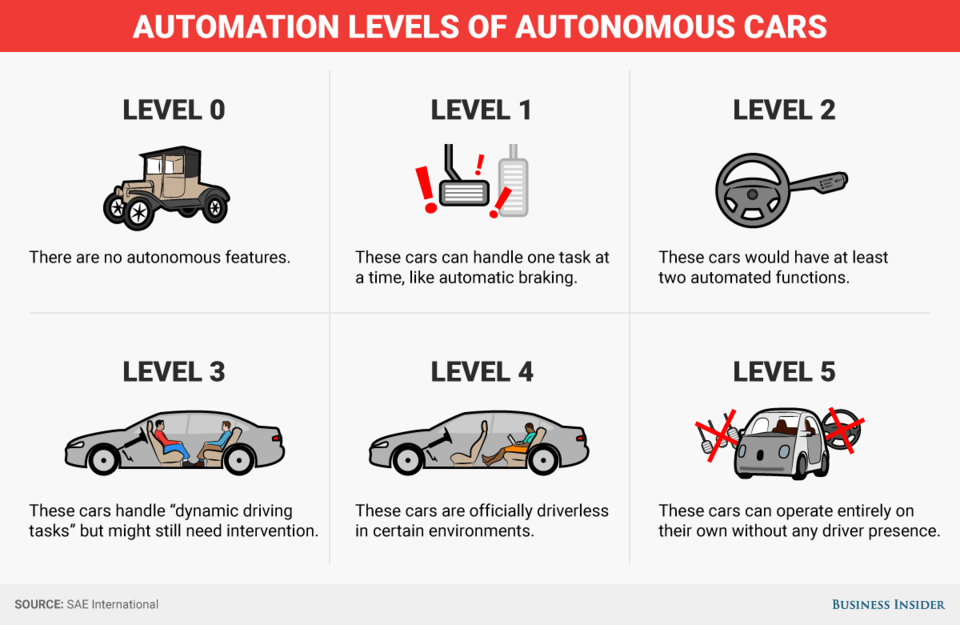

According to the U.S. Department of Transportation National Highway Traffic Safety Administration (NHTSA), there are currently six levels of automated driving, with the lowest levels being the least automated and higher levels being fully automated:

- Level 0 (No Automation) – The driver is in complete control and the system does not interfere but has more safety features like lane departure and collision warning systems.

- Level 1 (Driver Assistance) – The driver is in control of the vehicle, but the system can do small things like change the speed and steering direction.

- Level 2 (Partial Automation) – Level two is actually considered automated driving, but not autonomous, meaning that the system would expect a driver to be fully aware at all times in the car and be able to take over at any moment.

- Level 3 (Conditional automation) – A level three autonomous driving system has some dependency on a human driver taking over control occasionally.

- Level 4 (High Automation) – The system is in complete control and human presence is not needed, but its applications are limited.

- Level 5 (Full Automation) – The system is in full control and human control is not needed.

There are currently no fully automated level five vehicles, but there are level fours, like Google car for example.

What will insurance policies look like in 10 years when driverless cars gain more traction?

Many predict that in a few years, most people won’t own cars. Instead, they’ll rent driverless cars for their commute from companies like Zipcar.

If these predictions are correct, insurance policies will probably look a lot like regular auto/rental insurance, but with a few more bells and whistles.

For instance, if you leave something of yours in the ride-sharing car, it’ll be covered!

Another growing trend in the car insurance industry is the usage-based model.

MetroMile is a car insurance company that allows you to only pay for as much coverage as you need based on your commute.

Right now, some of the biggest autonomous car insurance companies are Waymo and Trov.

Harvard Business Journal predicts that insurance companies will experience a $25 billion loss by 2026 due to autonomous cars.

Another article from Business Insider suggests that the car insurance sector could shrink 60% by 2024 even though there is a rising need for car insurance.

Ford has plans to roll out a fleet of driverless cars without a steering wheel or pedals in 2021.

Additionally, logistics companies like FedEx and UPS are likely to switch to autonomous vehicles within the next few years.

So, how can car insurance companies prepare for the future?

Here are a few ways insurance companies can prepare for the future of automated driving systems:

Invest in data and analytics

The future lies in data and analytics.

It’s important to consult with experts and gather data to analyze and understand the risks and rewards of insuring driverless cars.

Have a plan

Having a plan of attack before all this change happens is always a good idea. Be sure all components of your company are on the same page about the shift and that they know what to expect.

Learn everything you can about autonomous cars – become an expert. The more you know, the better off you’ll be.

Consider bringing on new people who are experts in technology, data or analytics.

Explore new business models

One thing you might consider is a new business model for your company.

Autonomous cars are guaranteed to shake up the insurance industry, so personal automobile insurers may need to change and adapt to be able to cover larger risks with fewer policies.

Change is inevitable but good. When it happens, make sure you’re ready.

However, insurance companies can rest assured: the shift to driverless cars will be very gradual.