Introduction

It was announced earlier this month that retail giant Toys”R”Us will be closing all of its stores this year.

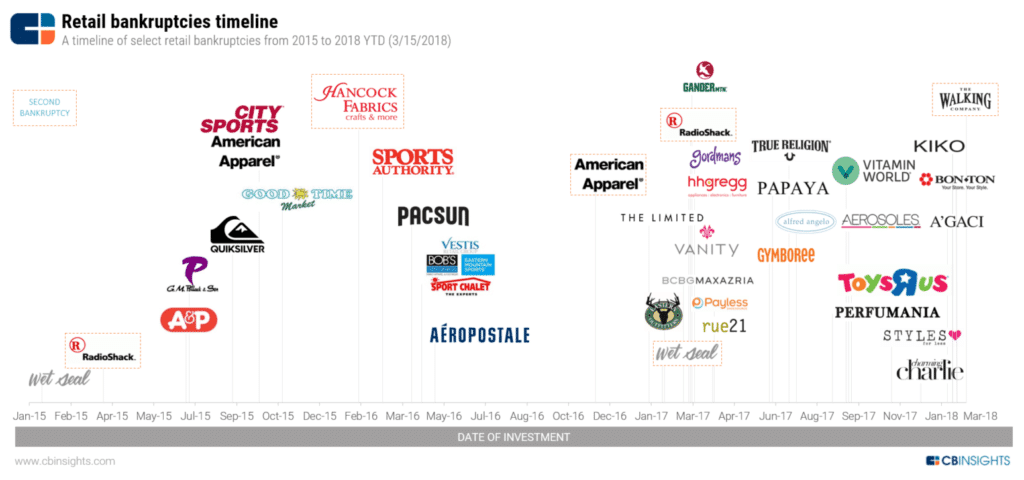

The demise of the toy company comes as no surprise, as several other once-booming retail stores have also declared bankruptcy, including Payless and Claire’s.

Sears is also facing a shutdown and has already closed many of its stores.

Although the U.S. economy has been on the rise, more retailers are filing for bankruptcy now than during the 2008 financial crisis.

The decline of retail is due in part to the popularity of online shopping centers, prompting many to blame Amazon.

Others blame millennials and their frugal spending habits – studies show that younger generations spend more money on experiences than products.

But, it was something else that killed that retail industry.

All of these companies went bankrupt due to a crippling amount of debt.

A recent survey by BDO found that 94% of retail executives expect the rate of bankruptcies to continue throughout 2018, with 40% predicting that the number of bankruptcy filings will actually worsen in 2018.

On September 18, 2017, Toys”R”Us announced that it filed bankruptcy, the third-largest retail bankruptcy in U.S. history.

Then, on March 15, 2018, the company announced plans to liquidate the inventory in all 735 of its U.S. stores.

Although Toys”R”Us was profitable, the chain struggled to refinance its massive amount of debt, totaling $5 billion.

Sears has also been struggling.

The department store chain has accumulated over $4.4 billion in debt but was recently able to refinance about $500 million.

As a result, credit rating agencies downgraded the debt to default status, stating, “We believe the transaction constitutes a distressed exchange.”

In a press release, Sears CEO Eddie Lampert said that refinancing the debt “will strengthen our financial footing as we continue to execute on our strategic transformation.”

“We remain resolutely committed to enhancing our liquidity and working aggressively to return the company to profitability,” he added.

These retail stores are overloaded with debt, often from leveraged buyouts by private equity firms.

Conclusion

Avoiding bankruptcy is no longer as simple as refinancing and investors are weary due to a shifting market.

According to a report by Moody’s, $1 trillion in high-yield debt from all distributors will come due over the next five years, leading credit markets to tighten and become much less accommodating to distressed borrowers.

And, collection rates on retail credit card portfolios are declining due to the fact that consumers are less willing to pay back retail credit card balances if that store has closed.

Will the retail industry be able to turn around, or will debt claim another victim? Only time will tell.