Introduction

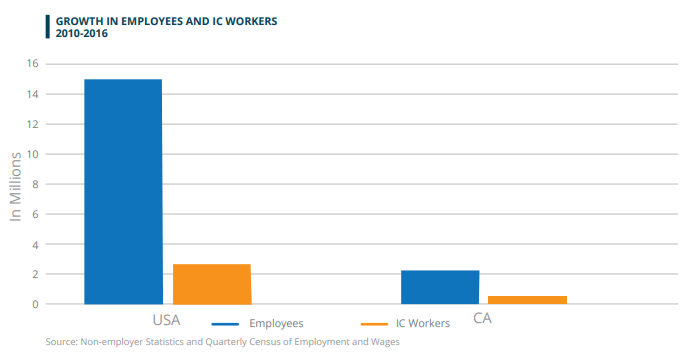

California recently passed a controversial worker classification bill that has shaken up the state’s gig economy.

On Sept. 18, 2019, California Governor Gavin Newsom signed Assembly Bill 5 into law, which will amend the state’s Labor Code to include the “ABC” test for classifying independent contractors.

About Assembly Bill 5

Under Assembly Bill 5 approximately 500,000 California workers who are considered independent contractors will need to be reclassified as employees.

In a signing statement published by the Office of the Governor, Newsom wrote that the new law will “help reduce worker misclassification — workers being wrongly classified as ‘independent contractors’ rather than employees, which erodes basic worker protections like the minimum wage, paid sick days and health insurance benefits.”

California Assemblywoman Lorena Gonzalez, the author of Assembly Bill 5, insists the goal of this law is “to create new good jobs and a livable, sustainable wage job.”

Proponents of the new law point to audits conducted by state employment officials that found almost half a million workers were wrongly classified as independent contractors.

But the reason why many companies are fighting back is that independent contracting is typically associated with cost savings.

With independent contractors, employers save money because they are not required to pay payroll taxes and are not liable for workers’ compensation insurance, unemployment insurance, disability insurance or social security.

Under Assembly Bill 5 employers would be forced to shoulder the cost of complying with minimum wage laws, paying payroll taxes and providing employee benefits.

And while there are some obvious benefits to freelancers and independent contractors, many feel that the new law will restrict the freedom they enjoy as nontraditional employees.

In fact, a survey by Upwork found that 51% of freelancers wouldn’t take a traditional job over freelancing, no matter how much money they were offered.

Furthermore, minimum wage and overtime regulations do not apply to independent contractors, nor do employers have to comply with other wage and hour requirements such as providing meal and rest breaks, or reimbursing workers for business expenses.

Restraints on independent contracting also affect the benefits that many workers enjoy from such arrangements, such as the flexibility of choosing when and how many hours they work, and the opportunity to supplement primary sources of income.

Others are worried the new law will kill the state’s gig economy and drive corporations out of California — like Uber, Lyft and DoorDash.

Uber, Lyft and DoorDash have already partnered up and launched a $90 million campaign against the new legislation, introducing a ballot measure called the Protect App-Based Drivers & Services Act which includes provisions that guarantee to pay drivers 20% more than minimum wage, reimburse them for expenses such as gas and vehicle depreciation, and provide a health care stipend.

Voters will likely get the chance to vote on the ballot measure during the November 2020 election.

Conclusion

Some attorneys believe more states will follow in California’s footsteps, like Illinois and Massachusetts.

The new law will take effect on Jan. 1, 2020, meaning California insurers could lose out on premium if they’re not auditing workers’ compensation policies.