Introduction

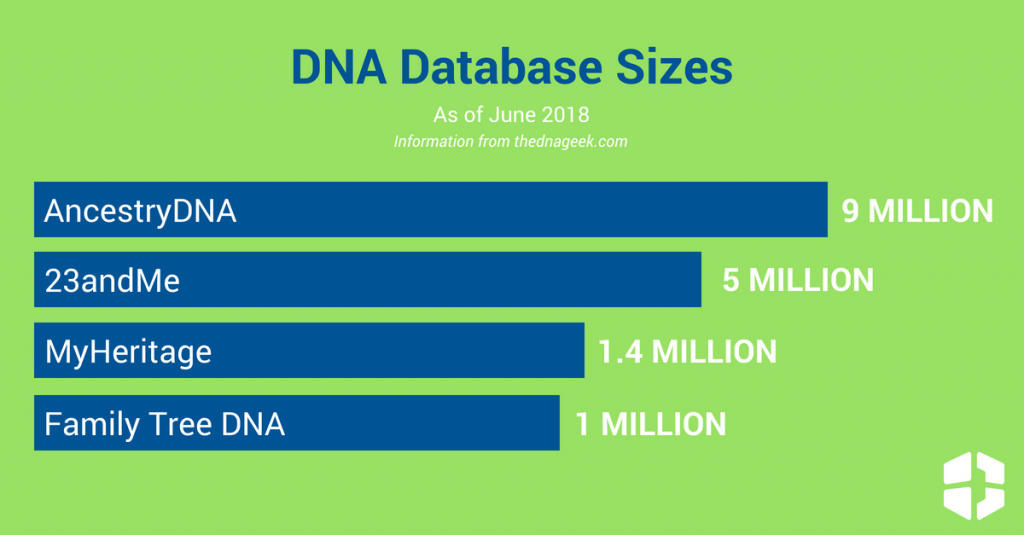

We’ve all seen the commercials for genetic testing kits on TV from companies like Ancestry and 23&Me.

For less than $100, you can send in your DNA to a variety of companies and find out your ancestry.

But, what most people don’t know is that the DNA you mailed in could be used against you.

That’s right — home DNA tests reveal more than just your ethnicity.

How are DNA databases used?

The Federal Trade Commission recently issued a warning, stating, “That tiny sample can disclose the biological building blocks that make you, you.”

This means that anyone who has access to your genetic information also has access to your family members, medical history and more personal information that could be used against you in a number of ways.

For example, DNA from a genealogy database was recently used to solve a 25-year-old cold case.

California law enforcement was able to track down and arrest the suspected “Golden State Killer,” a cold case that stumped law enforcement for decades — until a relative of the suspect took a home DNA test.

Investigators only had to plug the mystery killer’s DNA into the genealogy database GEDmatch to find someone who matched the killer’s description.

Without this genetic technology, the cold case may never have been solved.

Even so, many consumers feel that they should be able to use these genealogy tests without having to give up their rights.

Many consumers also beg the question: what else are these test results used for?

According to Jamie Court of Consumer Watchdog, “If you apply for life insurance they do have a right to get all your medical records. And if you’ve had a genetic test taken, they do have a right to request it.”

The Genetic Information Nondiscrimination Act (GINA), which passed in 2008, prevents health insurance companies and employers from discriminating on the basis of information that might be found in a genetic screening.

However, the law does not apply to life insurance companies, long-term care or disability insurance.

Information found in DNA tests could be held against you if a life insurer asks for it and it reveals genetic health risks, like cancer.

Once you take a DNA test, the results are out of your hands unless you make a special request that your sample be destroyed after testing.

On the flip side, insurance companies could lose out if not given equal access to genetic information.

If insurance companies cannot gain access to these results, a savvy consumer could have an advantage over the insurance company.

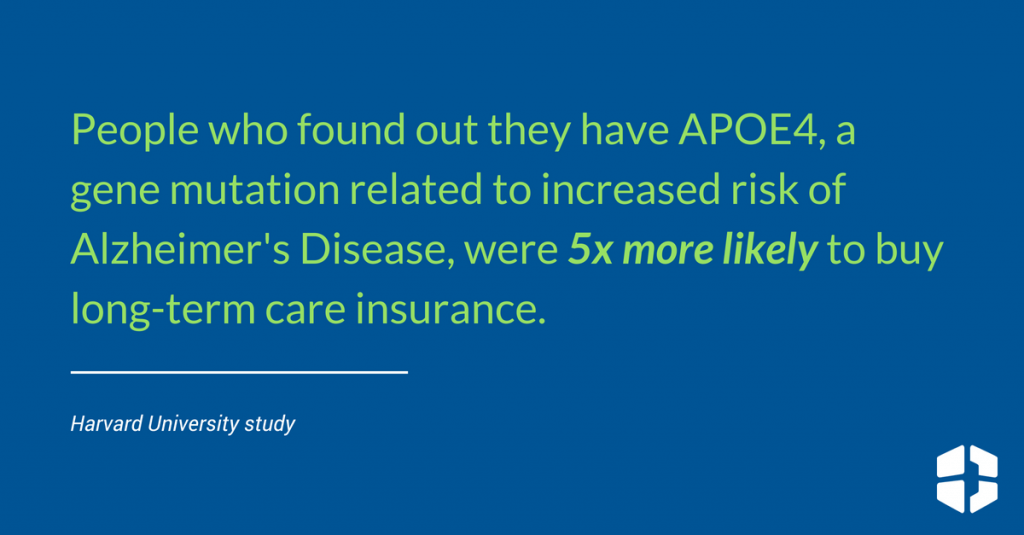

A study from Harvard University found that people who were told they have APOE4, a mutation of a gene related to increased risk of Alzheimer’s Disease, were five times more likely to buy long-term care insurance.

Additionally, life and health insurers could use the information to find early signs of cancer or cardiovascular disease and suggest medical intervention or a lifestyle change to mitigate the risk.

This could greatly help those who are already insured, but people seeking new policies worry they could face unfair discrimination based on test results.

Some could even lose access to insurance altogether, which raises questions about the ethics of privacy.

Conclusion

If predictive DNA tests further improve and become more common while non-disclosure rules stay in place, insurance companies could suffer greatly, which is why some insurers argue that if the customer knows something relevant about their health, so should the insurer.

What do you think? Should insurance companies be given access to DNA test results?

Or is it a consumer’s right to be able to withhold information from insurance companies?