Brown & Joseph specializes in Life Insurance Overpayment Recovery, helping insurers efficiently recover excess payouts, misdirected benefits, and duplicate payments thru our Recovery Expert Team.

Our data-driven recovery solutions, combined with industry expertise and compliance-focused strategies, ensure a seamless process that maximizes recoveries while maintaining policyholder relationships. As a trusted leader in life and health insurance collections, we provide customized recovery programs tailored to the unique needs of carriers, MGAs, and brokers. Partner with Brown & Joseph to streamline your overpayment recovery process and protect your bottom line.

Some of the common reasons for overpayment for life benefits are:

- Clerical Errors: Human errors, such as entering incorrect data or miscalculating benefits, can lead to life benefit overpayment.

- Miscommunication: Lack of clear communication between the provider and the beneficiary can lead to incorrect amounts being paid. This happens when the provider is unaware of changes in the beneficiary’s situation (such as income, eligibility, or marital status).

- System Glitches: Technical issues or software malfunctions in payment systems can sometimes result in overpayments.

- Eligibility Changes: If a person’s eligibility for benefits changes, but the provided system hasn’t been updated accordingly, overpayments can occur. Situations such as a beneficiary no longer qualifies for certain benefits but benefit payments continue, may result in overpayment.

- Delays in Reporting: When beneficiaries fail to report changes in their circumstances promptly, such as income increases, which could affect their benefit amount, can result in overpayments.

- Inaccurate Calculations: In some situations, when the rules for calculating benefits (such as age, earnings, dependency status) are not followed correctly, may result in overpayment.

- Overestimation of Benefit Amount: Providers may sometime overestimate the eligible amount or misinterpret benefit guidelines, leading to larger than necessary payments. This leads to overpayment.

- Fraudulent Claims: In some cases, fraudulent claims or intentional misrepresentation of information can lead to overpayment.

- Manual Overrides: When manual adjustments are performed to the benefits, without proper verification, it may lead to incorrect overpayments.

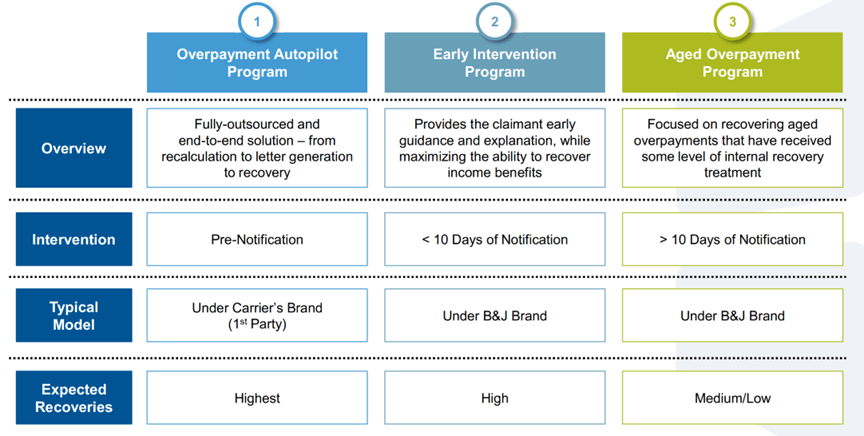

The Brown & Joseph team is highly focused on protecting our clients’ brands across each of these models – while preserving the claimant relationship and maximizing recoveries.

For more information and to contact a Brown & Joseph representative, please complete the form below: