For over three decades, prominent climate scientists have attempted to warn the public of the dangers of climate change.

In simple terms, climate change can be defined as the warming of the Earth’s climate system, including its atmosphere, oceans and land surfaces.

Most scientists agree that the main cause of climate change is human activity, such as burning coal and oil.

Over the last century, this activity has increased the concentration of atmospheric carbon dioxide, trapping more of the Sun’s heat in Earth’s atmosphere and leading to global warming.

While rising temperatures may not sound so bad, the results can be catastrophic.

In fact, if the sea level were to rise just four meters due to melting glaciers, almost every coastal city in the world would be underwater.

Now, as global temperatures continue to rise and natural disasters become more frequent, it seems more Americans are willing to accept climate change as a serious threat.

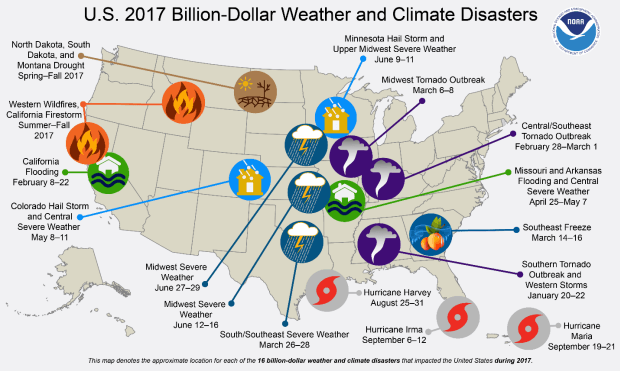

In 2017 there were 16 separate, billion-dollar natural disasters in the U.S. that can be linked to climate change.

New evidence also suggests that climate change is happening much faster than scientists had initially thought.

A recent report from the International Association of Insurance Supervisors (IAIS) and the Sustainable Insurance Forum (SIF) found that climate change points to a “growing trend of damages, both for insured and uninsured goods.”

Climate change is recognized by the world’s governments, the private sector and civil society as a serious global threat that is impacting human, environmental and economic systems – which includes the insurance industry.

“It is important to recognize that insurers may be well-versed in understanding the dynamics of such extreme events, and may [be] able to adjust exposures through annual contract re-pricing,” the report states.

“However, the potential for physical climate risks may change in non-linear ways, such as a coincidence of previous un-correlated events, resulting in unexpectedly high claims burdens.”

Additionally, the report notes that there is strong scientific evidence to suggest that climate change is having an influence on the frequency, severity and distribution of natural disasters.

Studies mentioned in the report that have explored this evidence include:

- Research by the World Meteorological Organization has concluded that 80% of natural disasters between 2005 and 2015 were in some way climate-related

- A recent analysis of 59 studies in English-language scientific journals published between 2016-2017 found that 70% of studies concluded that climate change has increased the risk of a given extreme event, such as heat, drought, rainfall, wildfires and storms

- Analysis by MunichRe has identified a long-term trend in an increase in the number of natural catastrophes around the globe, predominantly attributable to weather-related events like storms and floods

The insurance industry as a whole plays a vital role in the management of climate-related risks and opportunities for individuals, households, firms, other financial institutions and public authorities.

Building on three decades of catastrophe risk modeling, risk pricing, research and underwriting, the insurance industry is uniquely positioned to assist governments and other stakeholders in building financial resilience to the risks of climate change.

The National Association of Insurance Commissioners (NAIC) stated in a report from July 2018 that the “disclosure of climate risk is important because of the potential impact climate change can have on insurer solvency and the availability and affordability of insurance across all major categories.”

The need for the insurance industry to evolve and adapt to climate change threats is clear.

A report from Lloyd’s titled Climate Change: Adapt or Bust states that the insurance industry can no longer treat climate change as some peripheral workstream — instead, it must treat climate change as an opportunity to make a difference for the betterment of society.

The report further argues that it is time for the insurance industry to take a more leading role in understanding and managing the impact of climate change.

“The insurance industry must start actively adapting in response to greenhouse gas trends if it is to survive…”

The report concludes with an ominous warning for the insurance industry: “The insurance industry must start actively adapting in response to greenhouse gas trends if it is to survive… There could hardly be a debate of greater importance to the insurance industry.”