Brown & Joseph recovery team specializing in long-term disability (LTD) overpayments has both technical and interpersonal skills related to LTD. Our LTD team has in-depth understanding of disability insurance policies, including terms, conditions, and procedures within long-term disability (LTD) insurance policies.

Brown & Joseph LTD team is well versed in compliance & regulations, including legal framework around disability insurance, contracts, the statute of limitations or any potential defenses the individual may have is important.

Our LTD recovery experts perform various analysis to identify the reason for overpayment. Some of the common reasons for long-term disability (LTD) overpayment are:

- Failure to Report Changes in Income or Employment Status: If the person receiving LTD benefits starts working part-time or returns to full-time employment without reporting the change to the insurer, they may continue to receive the full LTD payment, resulting in overpayment.

- Clerical or Administrative Errors: Unintended mistakes by the insurance carrier, such as duplicating payments, processing payments at the wrong amount, or miscalculating benefit amounts, may result in overpayment.

- Incorrect Calculation of Benefits: If the insurer mistakenly calculates the monthly benefits incorrectly based on outdated or incorrect information (e.g., pre-disability income), this can lead to overpayment.

- Unreported Other Disability Benefits: In certain situations, recipients may be entitled to other disability-related payments (e.g., Social Security Disability Insurance, Workers’ Compensation). If these payments aren’t disclosed appropriately, the LTD insurer may continue to pay benefits without accounting for the additional income, leading to an overpayment.

- Delayed or Incorrect Medical Reviews: If medical reviews or assessments are delayed, the carrier may continue paying benefits beyond the period in which the person is eligible, causing an overpayment. Similarly, if an individual’s disability status changes but this is not reported or reviewed, payments might continue resulting in overpayment.

- Misunderstanding of Policy Terms: The person receiving the benefits may misunderstand the terms of their policy or the conditions under which benefits will be adjusted or reduced, leading to continued payments after they no longer meet the criteria for full benefits.

- Recovery or Improvement in Health: If the individual’s health improves and benefit recipient no longer meet the medical criteria for long-term disability but fails to notify the carrier, this may result in overpayment of benefits.

- Family or Spousal Support: Sometimes, LTD benefits may be coordinated with other sources of income or benefits, like spousal or family support. If those are not reported properly, overpayments may occur.

- Mistakes in Reporting Disability Duration: The carrier may mistakenly believe that the disability has not been resolved, leading to continued benefit payments, resulting in overpayment.

- Errors in Claim Forms or Paperwork: Incorrect or incomplete information on claim forms and required paperwork, could lead to the wrong amount being paid, resulting in overpayment.

- Failure to Update Bank Account or Contact Information: If a claimant changes their bank account details and fails to update the insurance provider, payments might continue to go to the wrong account, leading to confusion and possibly unreported overpayments.

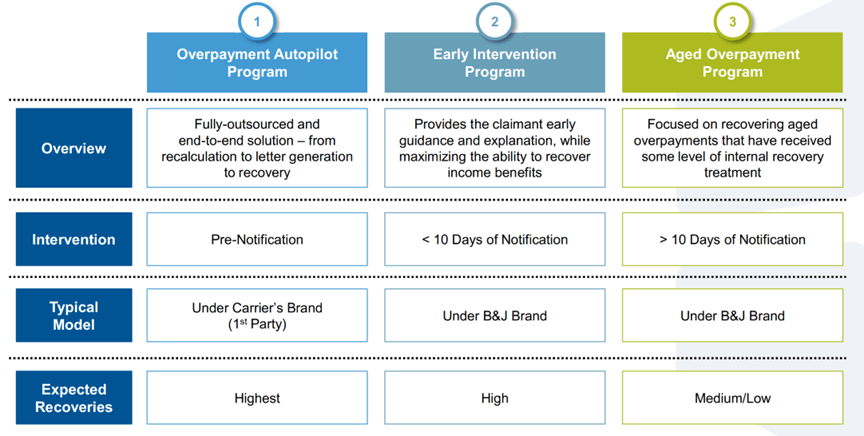

The Brown & Joseph team is highly focused on protecting our clients’ brands across each of these models – while preserving the claimant relationship and maximizing recoveries.

For more information and to contact a Brown & Joseph representative, please complete the form below: