Introduction

The majority of Americans are living beyond their means and accumulating massive amounts of bad debt.

In fact, a recent report by the New York Federal Reserve showed that U.S. household debt grew by $63 billion, or 0.5%, in the first quarter of 2018.

While living debt-free sounds nearly impossible in today’s world, it’s actually quite simple with some self-discipline and healthy spending habits.

Tips for living debt-free

1. Follow the 50/30/20 rule

The 50/30/20 rule was first coined by Harvard bankruptcy expert Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan” as a way to spend and save money.

The idea is to spend 50% of your income on your needs, 30% on your wants and put the remaining 20% into your savings account or toward debt repayment.

Keep in mind that these percentages are the maximum you should spend.

Spending less than these percentages can leave even more money for other financial goals.

2. Pay it off in full

Avoid credit card debt by paying off your balance in full each month, instead of letting it carry over.

There is a common myth that carrying a balance on your credit card will improve your credit score, but it’s better to pay it off in full.

This will save you from paying finance and interest charges and keep your debt-to-income ratio low, which is an important factor in determining your credit score.

If you can’t pay it off in full every month, try to keep your balance as low as possible, preferably under 30% of your credit limit.

The lower the balance, the better your credit score will be.

3. Read the fine print

Know what you’re agreeing to before you sign anything.

A CreditCards.com special report evaluated more than 1,200 card agreements for readability and found that the average card agreement was so complex that it was unreadable to four out of five Americans.

For example, when applying for a credit card, look over the entire application and take note of the interest rate.

If the fine print refers to your interest rate as a variable rate, this means it can change without notice if the prime rate increases.

4. Don’t rely on credit cards

Credit cards are nice to have on hand in case of an emergency but try to refrain from relying on them and using them constantly.

If you don’t have to charge something to a credit card, don’t.

Instead, try using the money you already have instead of borrowing more.

As financial expert Dave Ramsey once said, “Don’t rely on credit cards to catch you when you fall.”

5. Look for deals

A great tool for online shopping is Honey, a free extension for Google Chrome.

Honey automatically gathers all known coupon codes from the internet and applies them to your order at check out to make sure you’re getting the best deal.

Similarly, using a price comparison tool when doing things like shopping for a car or booking a flight can help find you the lowest price.

6. Prioritize

There are several tried-and-true methods for paying off debt recommended by financial experts:

Each method varies slightly, but the main idea behind each one is to prioritize your bills by paying off secured debts first, like auto loans and mortgages.

Then pay off unsecured debts like student loans, child support and taxes.

Next, pay off unsecured debts that are likely to appear on your credit report, and finally, unsecured debts that are least likely to go into collections.

However, remember that while some agencies don’t bother with smaller amounts, others specialize in collecting smaller amounts of debt.

There’s no way to tell if a debt will go into collections or not, so it’s best to just pay what you owe.

7. Set up automatic payments

The easiest way to make sure you don’t miss any payments is to set up automatic payments through your bank or through the creditor.

This way, all your payments are scheduled in advance and there’s no worry about missing a payment and damaging your credit score.

8. Budget

Creating a budget not only lets you know where your money is going, but it can also help you curb any unnecessary expenses.

There are dozens of easy-to-use apps available to help you manage your finances, like Mint or HelloWallet.

Mint is an app from Intuit that pulls all your accounts into one area for easier managing and gives insights into your spending habits.

In addition to making a budget, Mint also allows you to set bill payment reminders and see your finances in clear and easy-to-read charts and graphs.

Intuit has an array of useful tools for budgeting and keep track of expenses like Turbo, which allows users to effectively gauge their financial health.

Similarly, the HelloWallet app is designed to help you make smarter money decisions so you can reach your financial goals.

This app provides expert guidance and tools to help you make the most of your paycheck, from day-to-day spending to long-term planning.

9. Live within your means

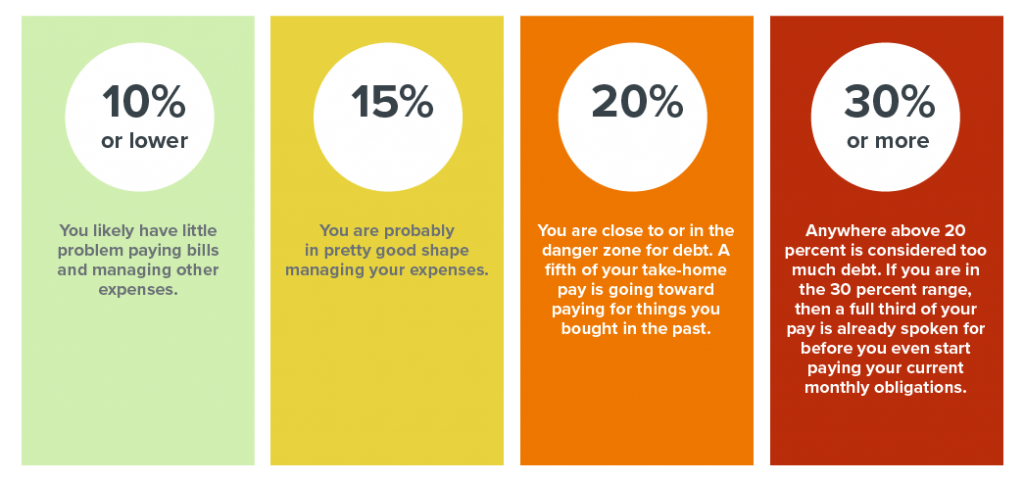

You can figure out if you’re living within your means by calculating your debt-to-income ratio.

To find this, add up all your monthly debt payments and divide that by your monthly gross income.

Ideally, your debt-to-income ratio will be below 10-15%.

Anything over a 43% debt-to-income ratio is a red flag to potential lenders and shows that you are living beyond your means.

10. Do your research

Before making any big financial decisions, do your research on all loan options and possible negative consequences.

You could even make a comparison chart of all your options so you can definitively see which is best!

11. Use your resources

If you do find yourself in debt, there are many resources and programs that can help, like repayment plans or loan modification plans.

Another great thing to do is to read personal finance books and blogs. You can learn a lot about yourself and money.

Intuit also has lots of free resources to help you manage your finances, like a tool that allows you to see how you compare your financial health with other Americans your age to determine where you stand.

NerdWallet also has a free debt calculator tool that will help you with budget-trimming and saving.

12. Don’t ignore collection calls

Ignoring collection calls won’t make the debt go away and could make the situation worse by further damaging your credit score.

It’s best to acknowledge the debt and explain why you can’t pay it.

The collector or the credit card company may be able to help you out by with the interest rate and payment due dates.

You could also get on a repayment plan.

13. Make more, spend less

See if you can increase your income to cover your debt. Consider putting in more hours at work or getting a part-time job.

Thanks to the rise of the gig economy, there are more ways to earn money on your own time than ever before:

The side hustle is becoming mainstream, and it’s easy to do. Why not try to earn some extra money to pay off that debt?

Conclusion

In today’s economy, living without bad debt seems out of the question.

However, with some commitment and determination, living debt-free is entirely possible.